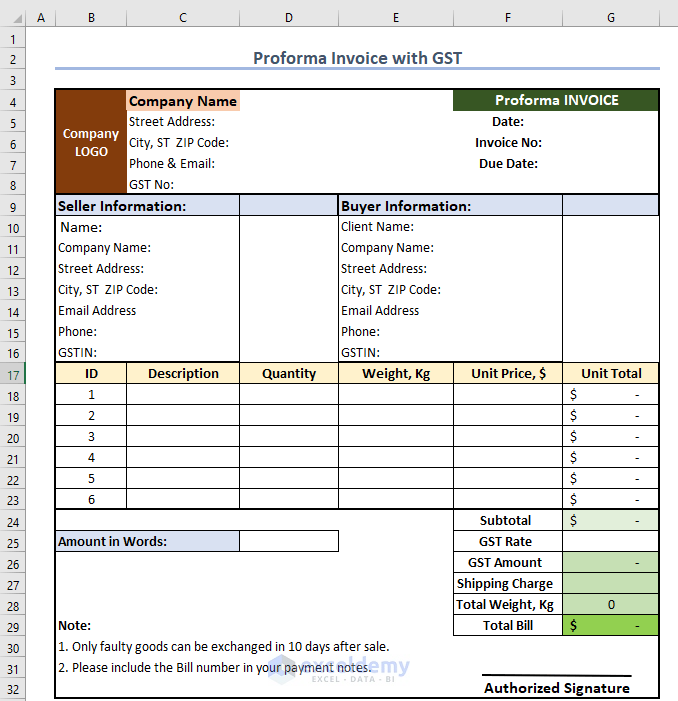

How to Create a Proforma Invoice Format in Excel with GST (Free Template)

A Proforma Invoice is a preliminary document that outlines the payable amount for a customer. It includes details related to product costs. Importantly, this is not the final invoice. When the buyer confirms the transaction, the seller sends this invoice as an acknowledgment.

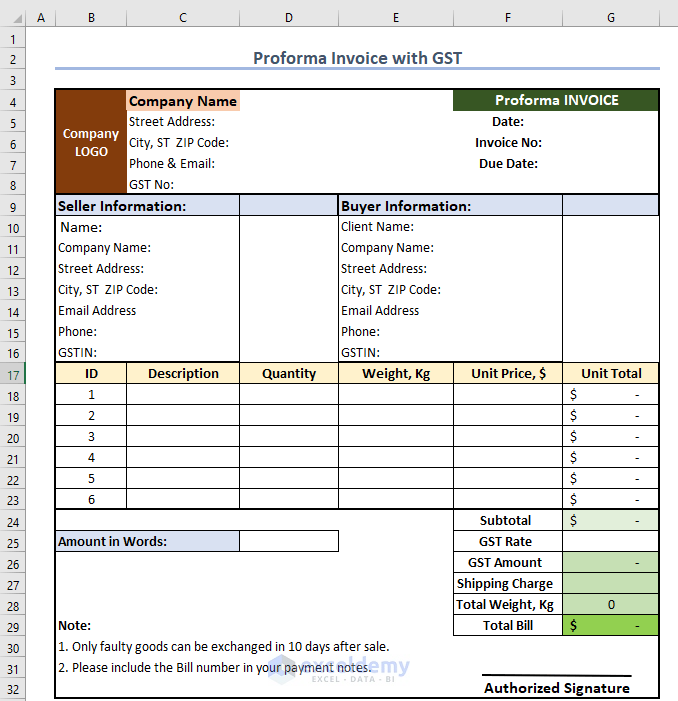

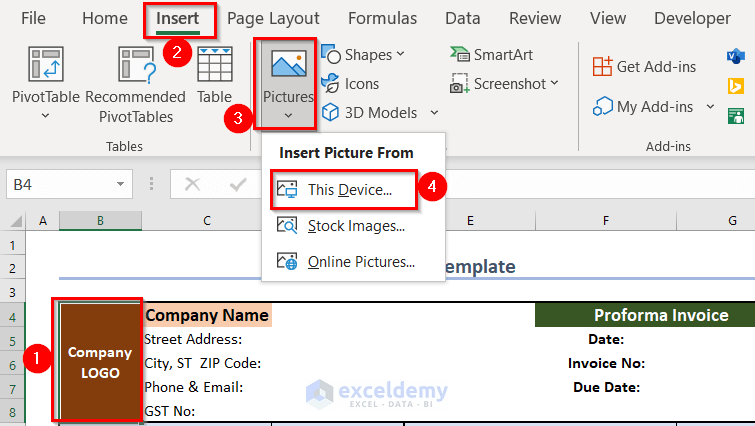

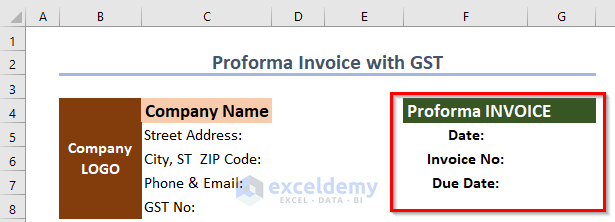

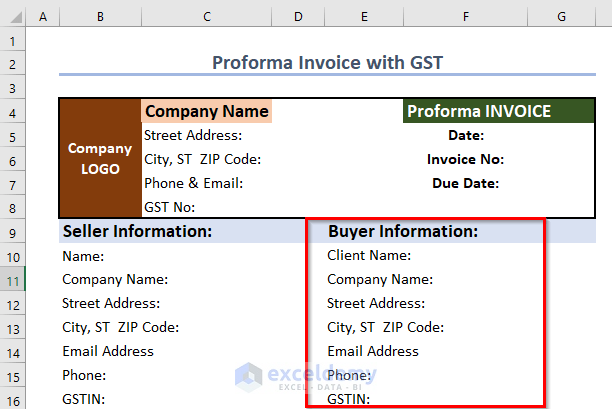

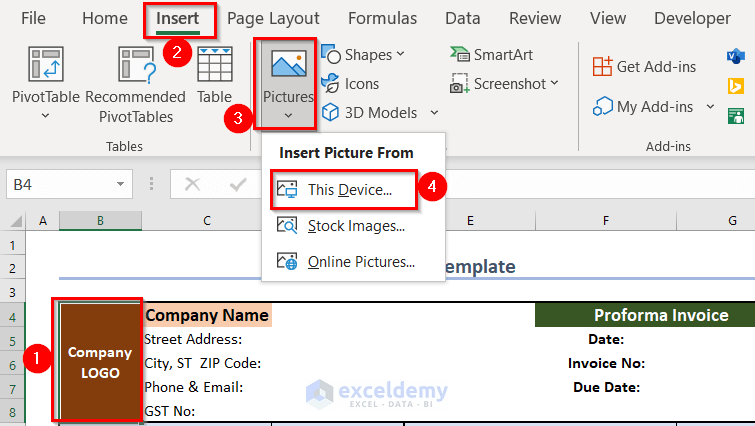

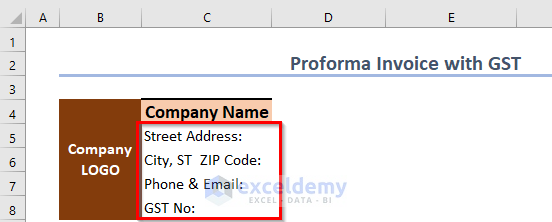

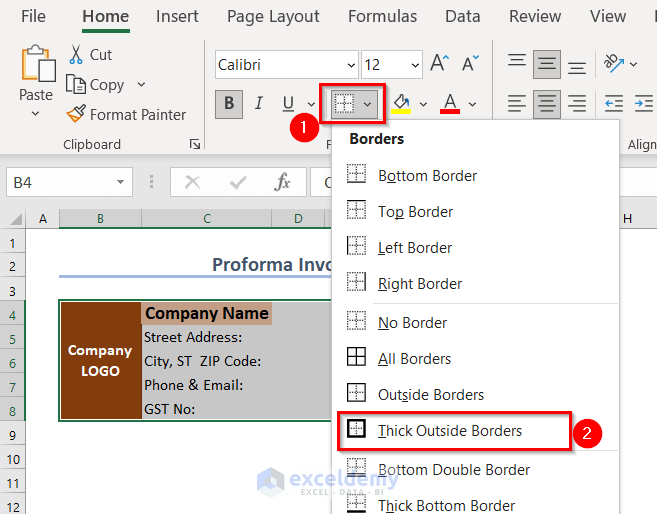

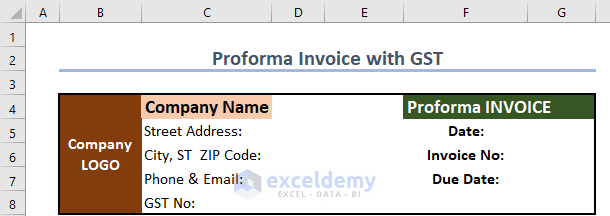

Step 1 – Include Company Logo and Details in Proforma Invoice Format with GST

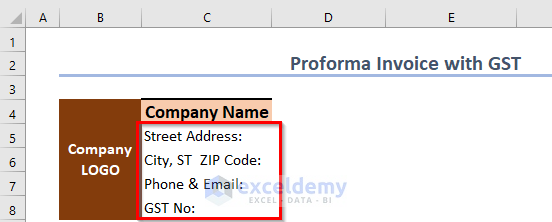

- Introduce your company by inserting the company logo and details in the Proforma invoice.

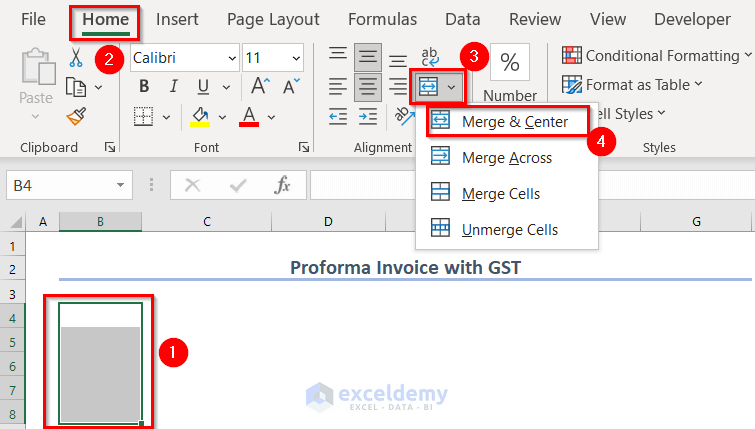

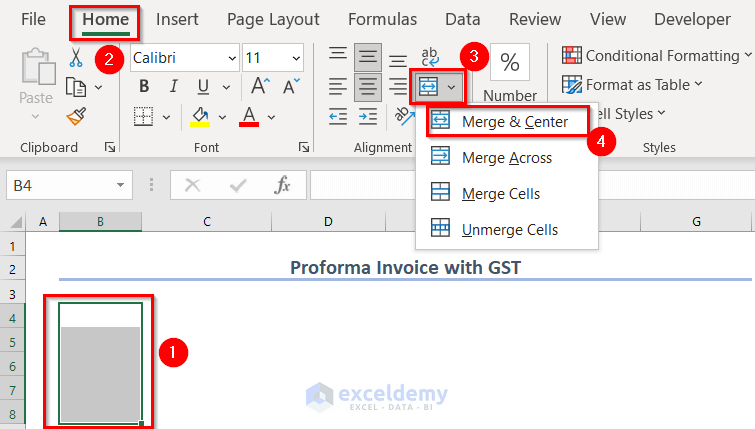

- Merge cells B4 to B8 to insert the company logo.

- Go to the Home tab and select the Merge & Center option.

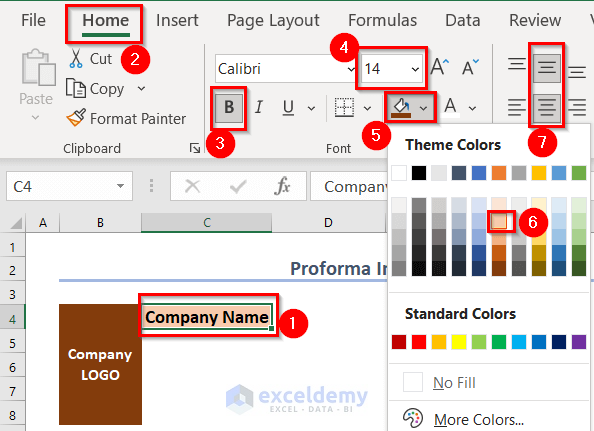

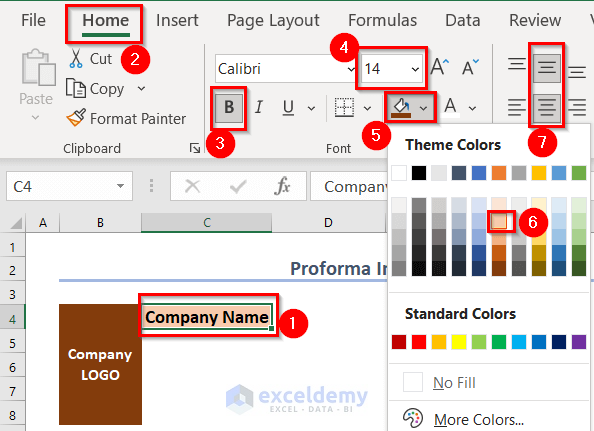

- Insert Company Name in cell C4, bold it, and adjust the font size.

- Fill in the following information in cells C5 to C8: Street Address, City, ST ZIP Code, Phone & Email, and GST No.

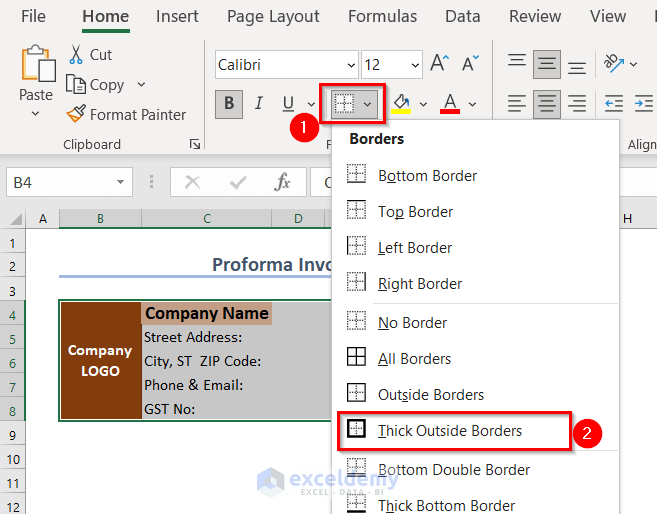

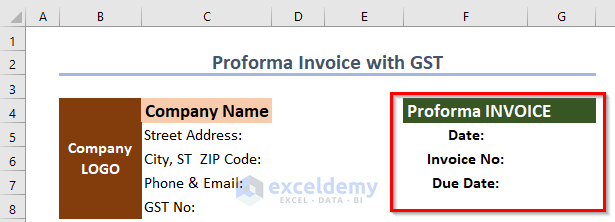

Step 2 – Add Invoice Information for Proforma Invoice

- In cell F4, write Proforma INVOICE (you can choose a fill color).

- Fill in the corresponding information in cells F5 to F7.

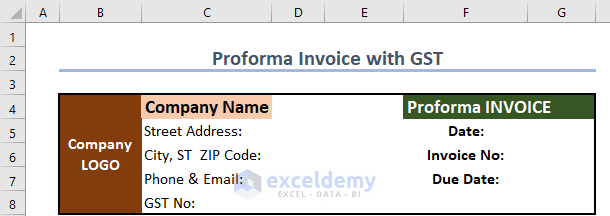

You will see the following output.

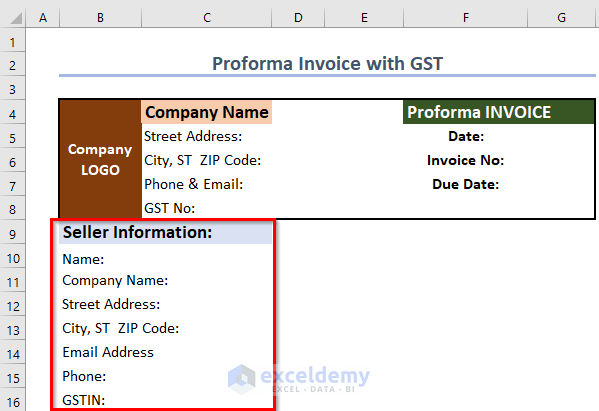

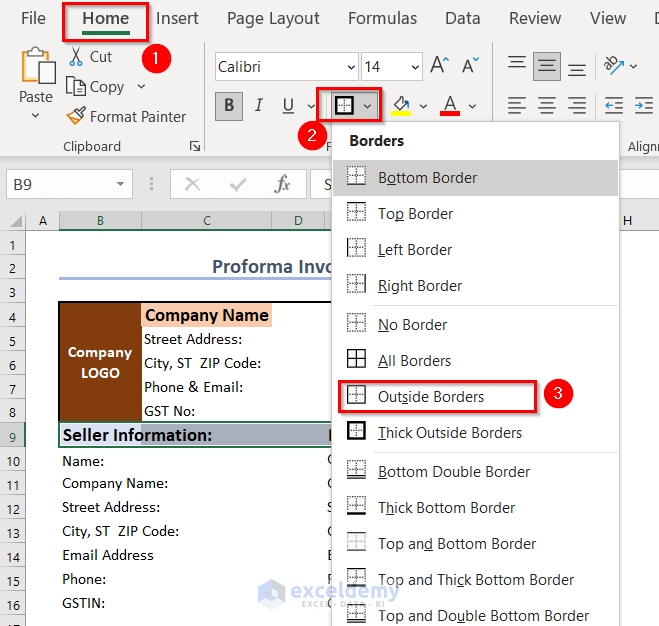

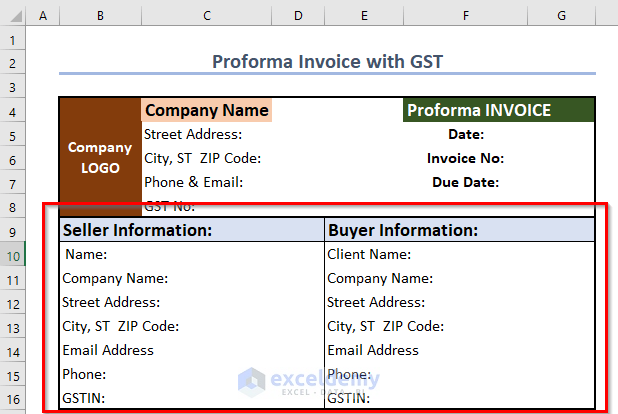

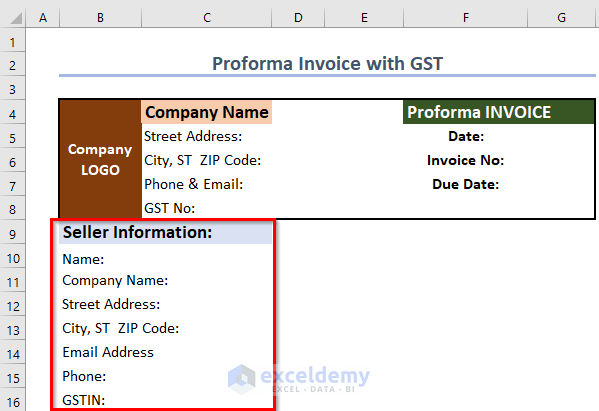

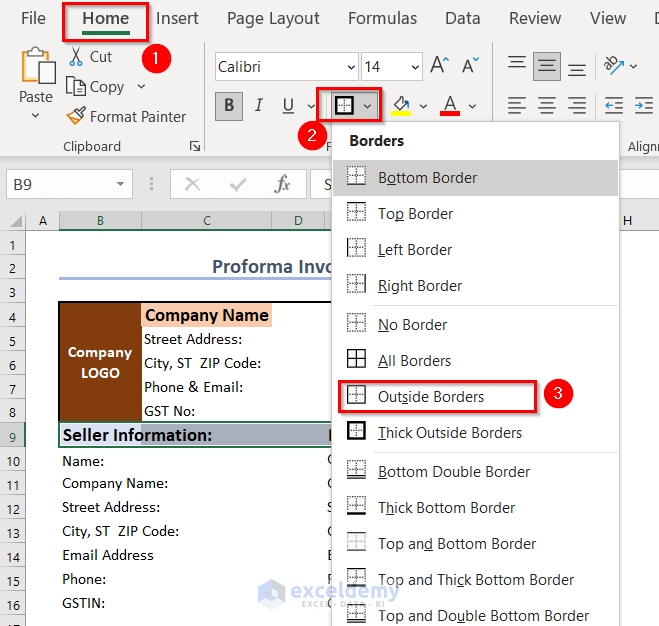

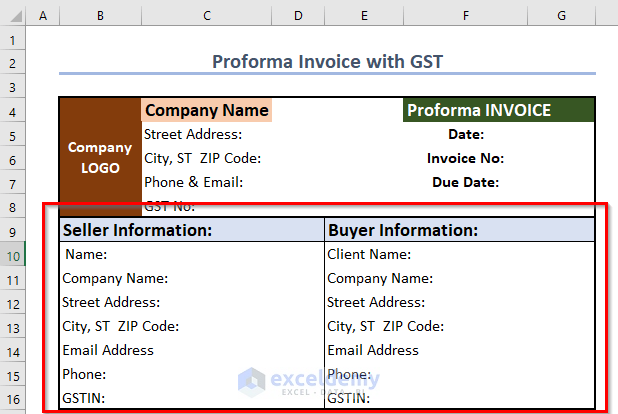

Attach Seller Information in Proforma Invoice in Excel" width="599" height="411" />

Attach Seller Information in Proforma Invoice in Excel" width="599" height="411" />

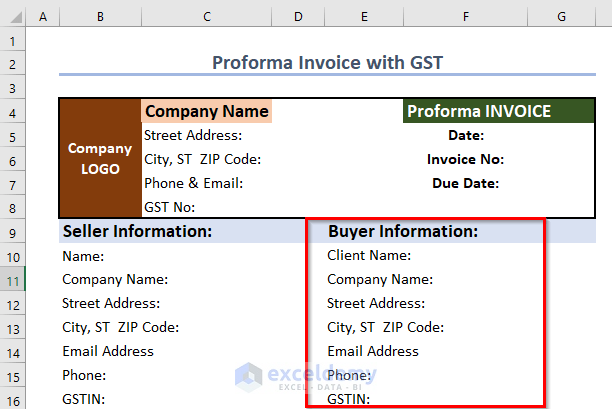

Step 4 – Add Buyer Information for Proforma Invoice

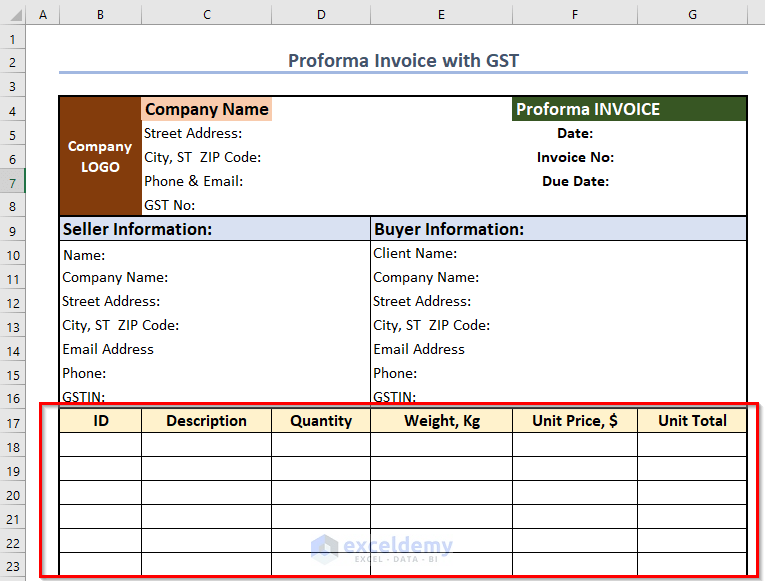

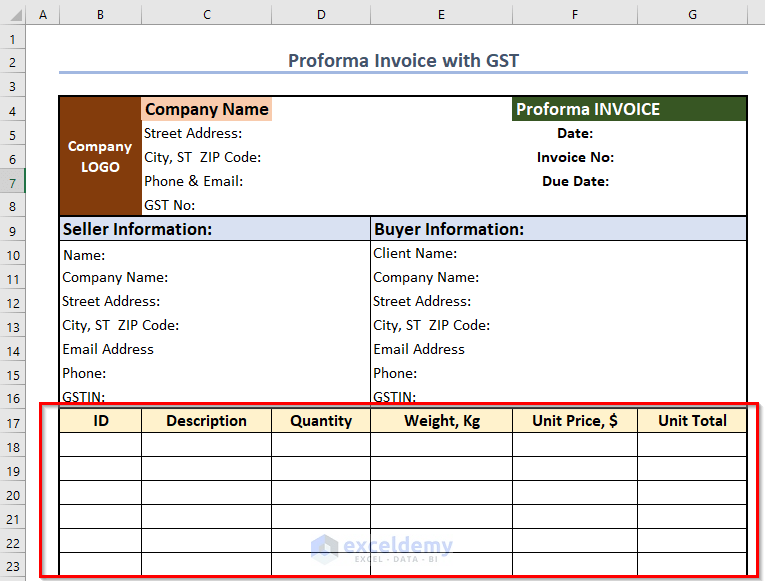

Insert Product Details in Proforma Invoice with GST" width="765" height="581" />

Insert Product Details in Proforma Invoice with GST" width="765" height="581" />

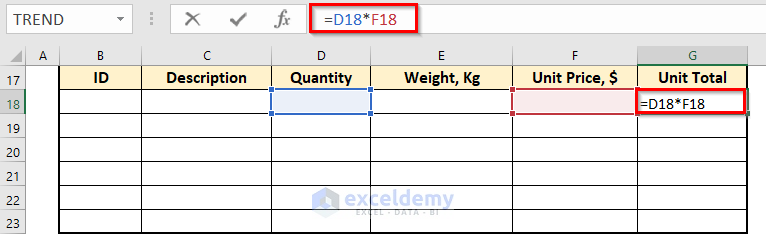

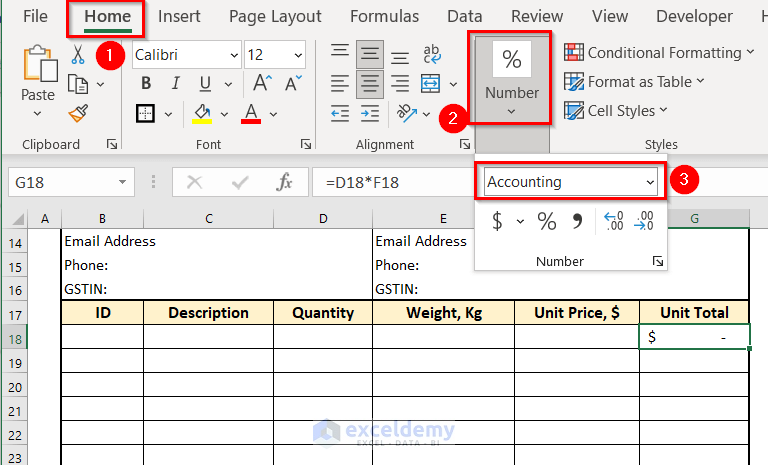

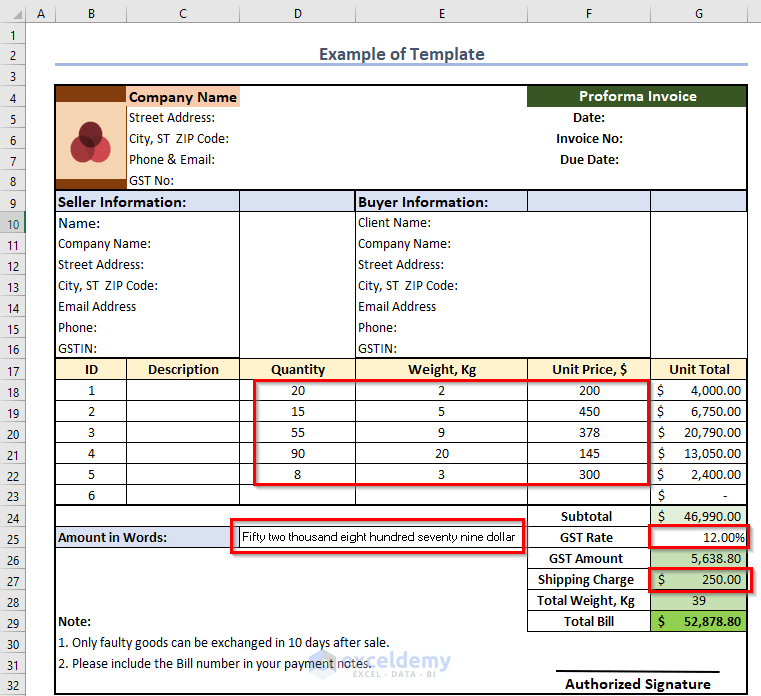

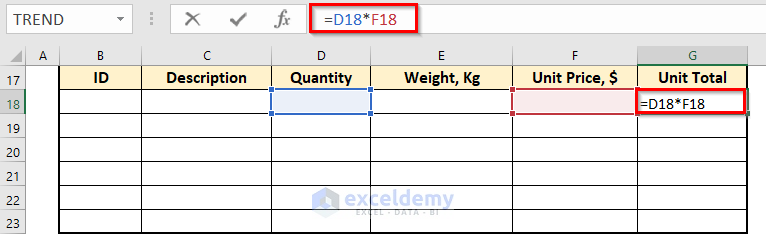

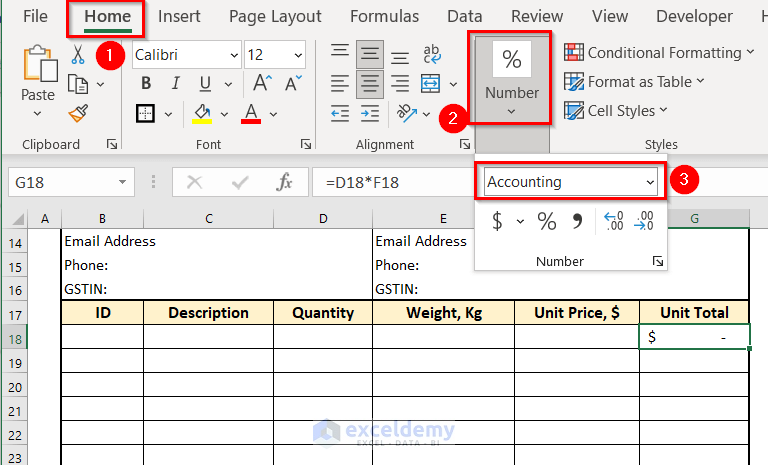

- Enter the following formula in the G18 cell to calculate the Unit Total (multiply Unit Price by Quantity).

=D18*F18

- Format the monetary symbol using the Accounting format (go to the Home tab and select Number).

- Repeat for the rest of the cells G19:G23.

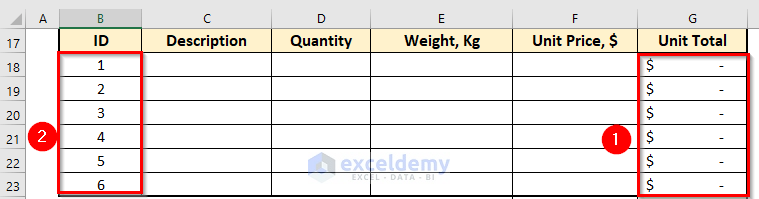

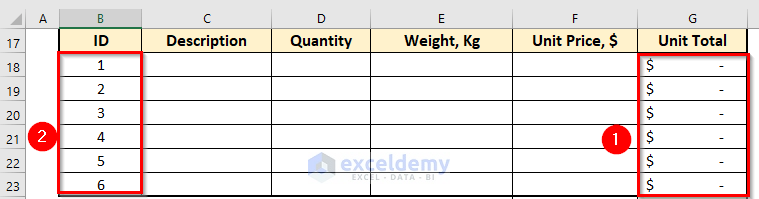

- Insert 1, 2, 3, 4, 5, and 6 for numbering the ID.

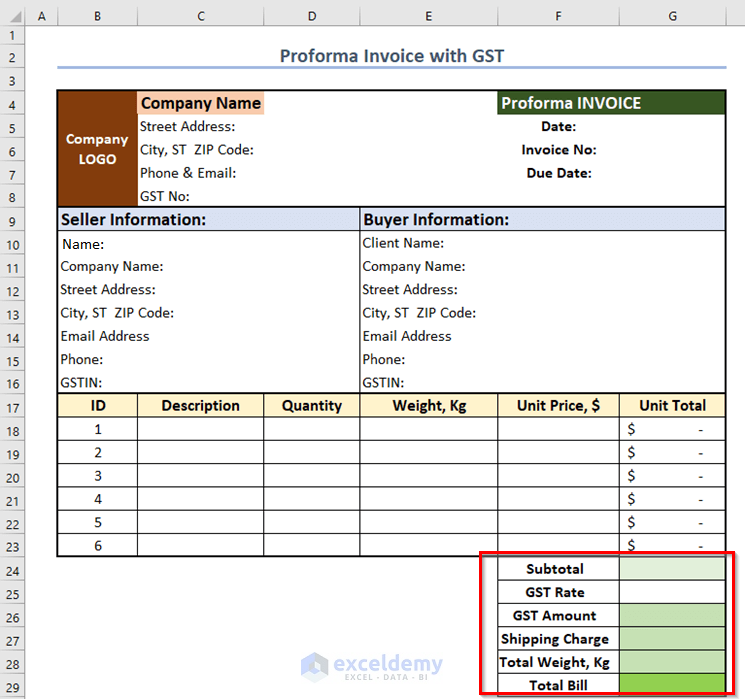

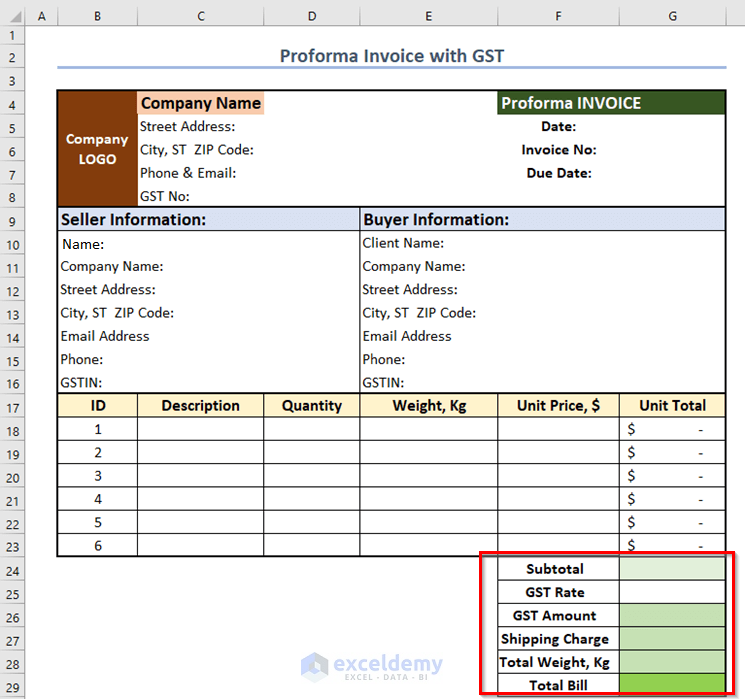

Step 6 – Include GST Rate for Proforma Invoice

Step 7 – Calculate the Total Bill in the Proforma Invoice Format with GST

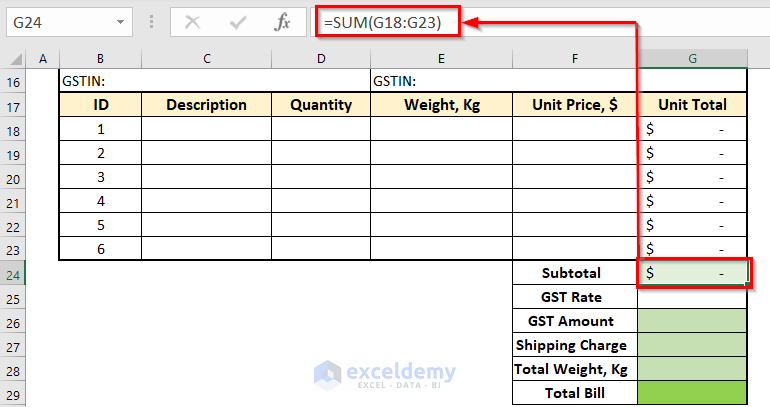

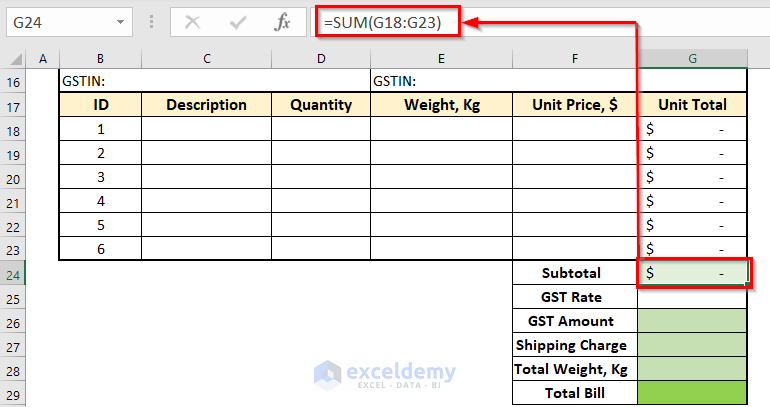

- Enter the following formula in cell G24 to calculate the total sum of all Unit Total prices.

=SUM(G18:G23)

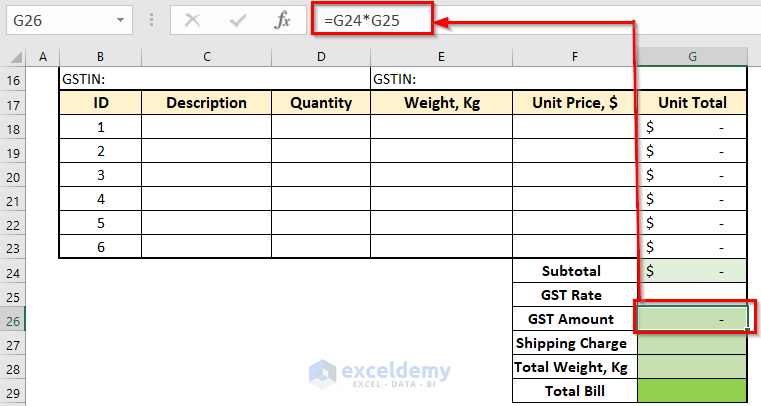

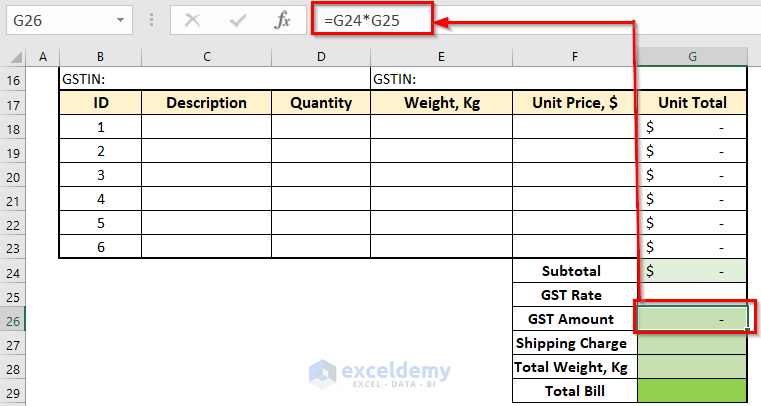

- Enter the following formula in cell G26 to multiply the GST Rate by the Subtotalamount:

=G24*G25

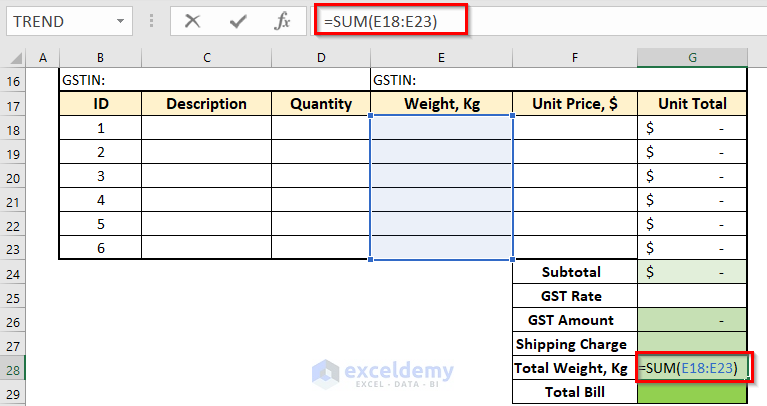

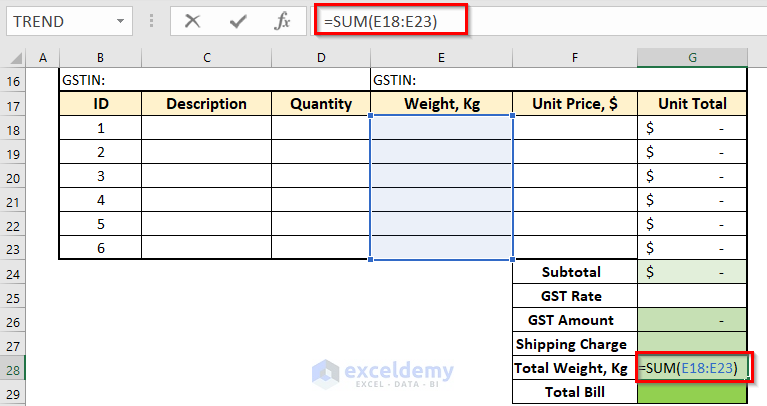

- Insert the following formula in cell G28 to sum up all the weights (E18 to E23) with the formula:

=SUM(E18:E23)

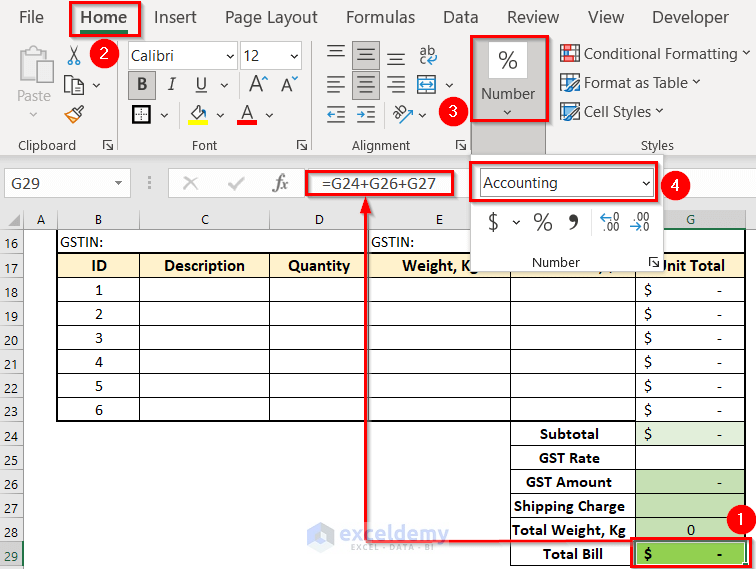

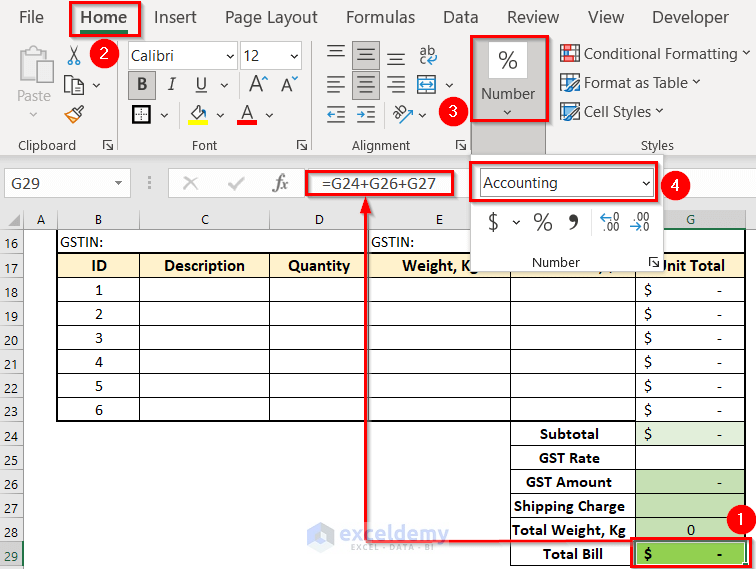

- Compute the total bill by adding the Subtotal, GST amount, and Shipping charge in cell G29 with the formula:

=G24+G26+G27

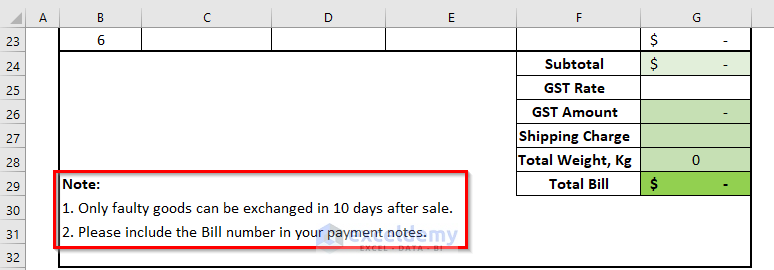

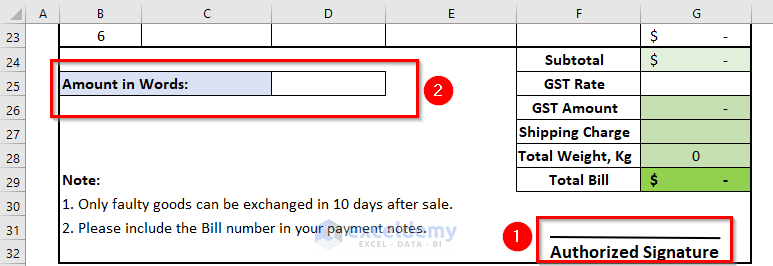

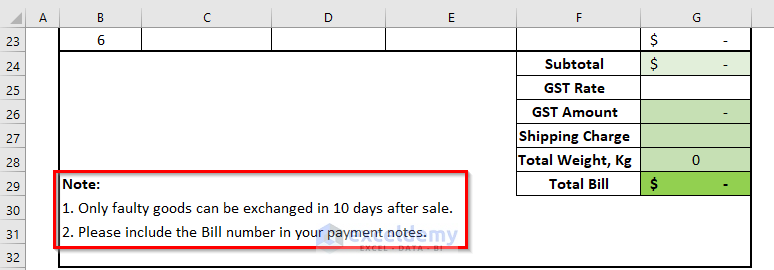

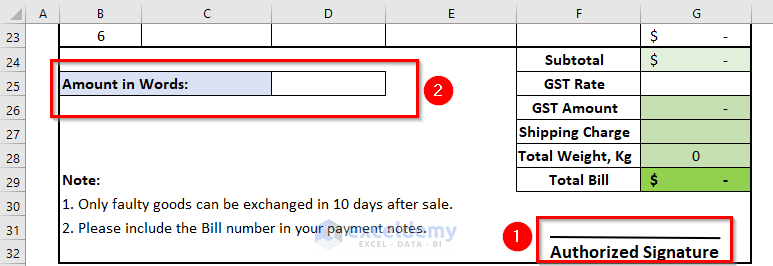

Step 8: Attach Terms and Conditions to Proforma Invoice

- Create a title like Note.

- Type your preferred terms and conditions according to your company policy.

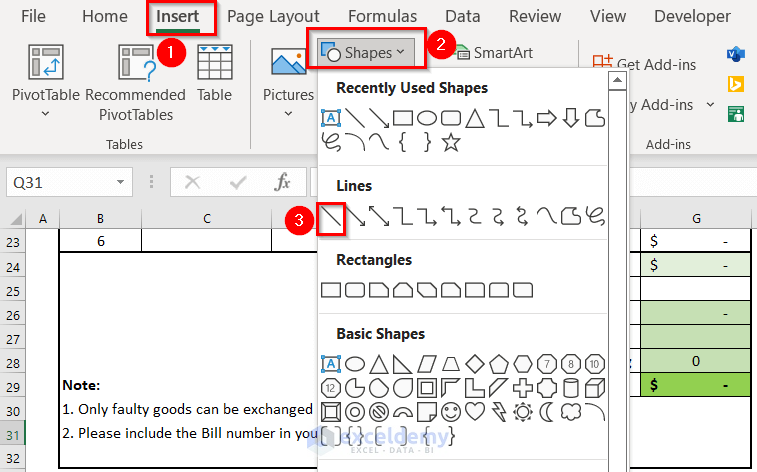

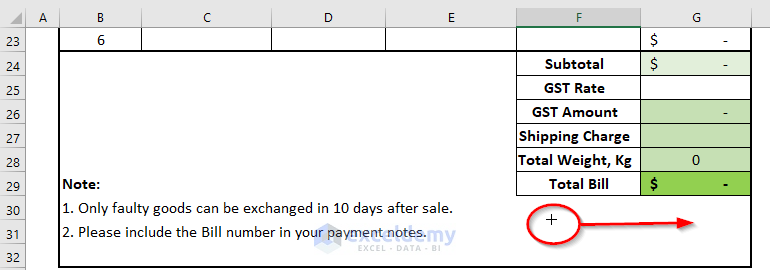

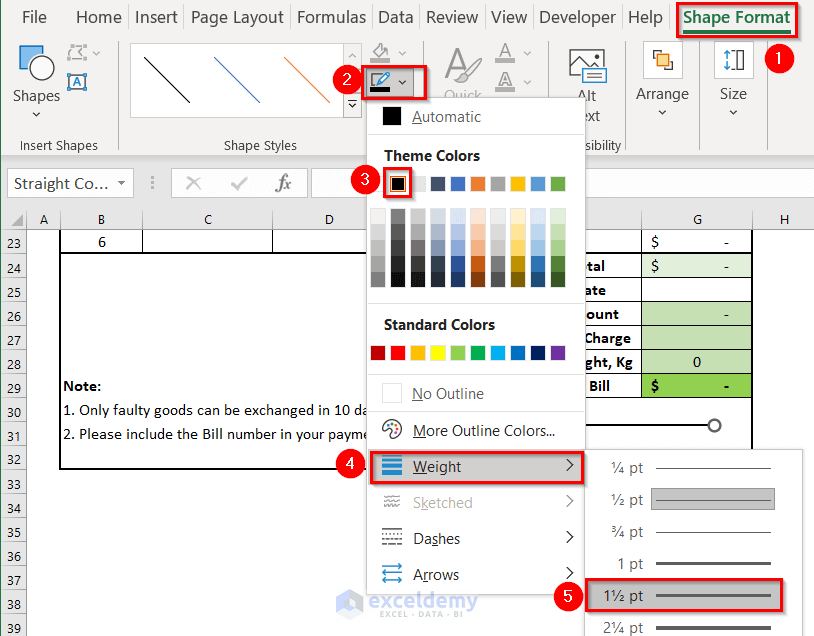

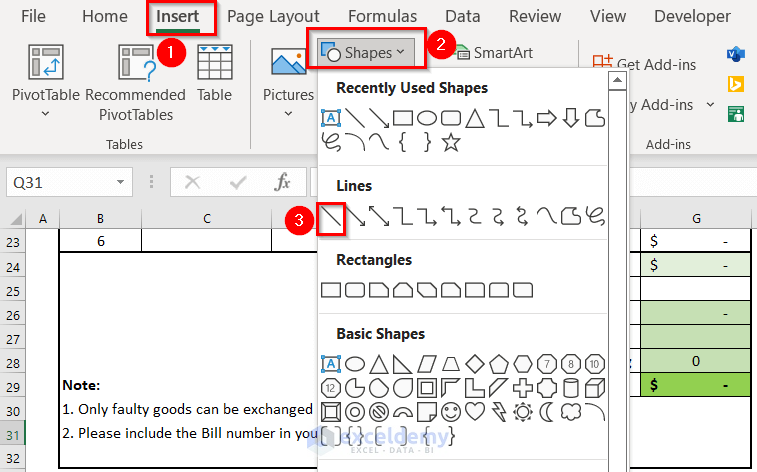

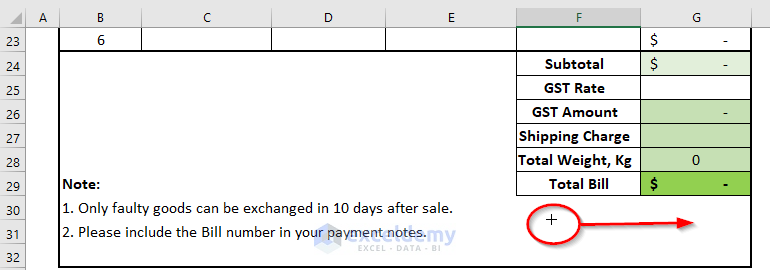

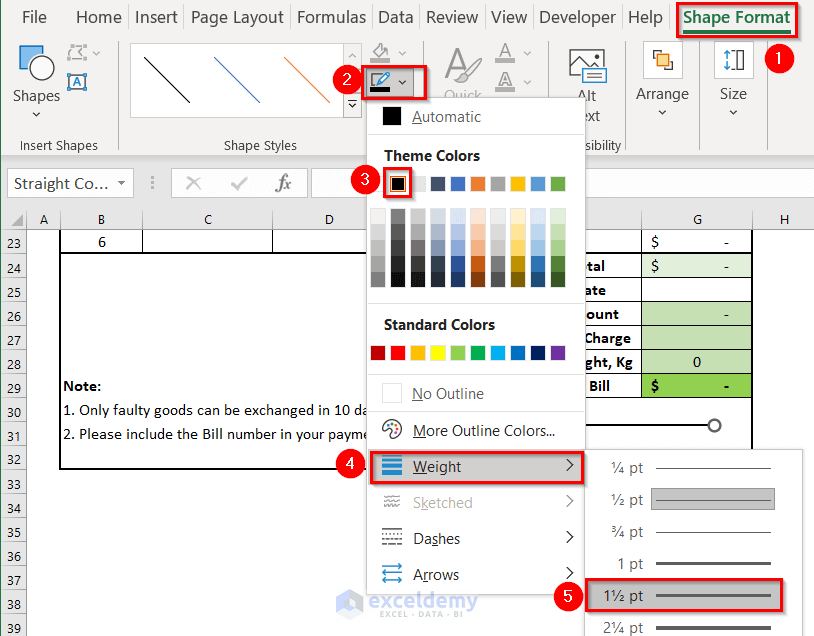

Step 9: Add Some Other Information in the Proforma Invoice with GST

- From the Insert tab, go to the Shapes feature and choose Line from the Lines option.

- Drag the mouse pointer to the specified place at the end of the invoice.

Your Proforma Invoice with GST is now ready.

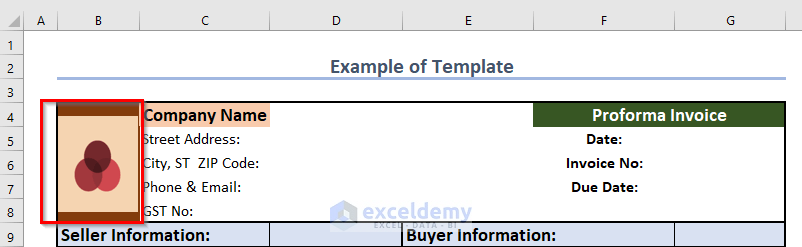

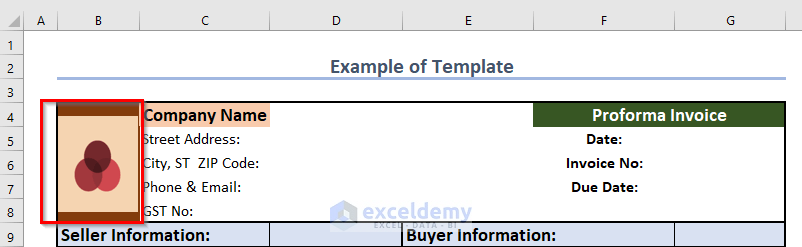

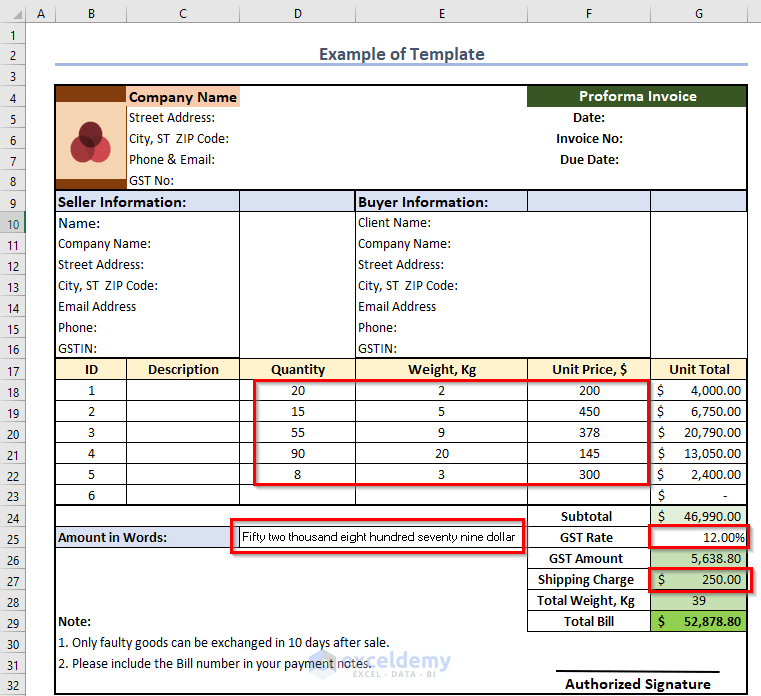

Use Template of Proforma Invoice with GST

- Add other information (e.g., product details). The calculations will be auto-updated, but you’ll need to manually enter the Amount in Words, GST Rate, and Shipping Charge.

Download Practice Workbook

You can download the practice workbook from here:

Proforma Invoice with GST.xlsx

Related Articles

- Create Non GST Invoice Format in Excel

- How to Create a Tally GST Invoice Format in Excel

- How to Create GST Rental Invoice Format in Excel

- How to Create GST Bill Format in Excel with Formula

Attach Seller Information in Proforma Invoice in Excel" width="599" height="411" />

Attach Seller Information in Proforma Invoice in Excel" width="599" height="411" />

Insert Product Details in Proforma Invoice with GST" width="765" height="581" />

Insert Product Details in Proforma Invoice with GST" width="765" height="581" />